Part 1 of a 2-Part Series on Landed Cost

Landed cost includes all expenses to get a product to your door, not just the purchase price. Microsoft D365 Finance & Supply Chain’s Landed Cost module helps businesses accurately track, allocate and analyze these costs, leading to better inventory valuation, improved profit margins and smarter purchasing decisions. It’s essential to truly knowing your product’s cost and boosting your bottom line.

Ever wonder about the true cost of something you buy, beyond just the price you see on the shelf? For businesses, figuring this out is super important, especially when they’re buying products from all over the world. This “real price tag” is called Landed Cost.

Think of it like this: If you order a new gadget online from another country, you don’t just pay the gadget’s price. You might also pay for shipping, customs fees and maybe even insurance to make sure it arrives safely. All those extra costs add up to the landed cost.

In the world of business, knowing the exact landed cost for every product is key to making smart decisions and staying profitable. That’s where Microsoft Dynamics 365 (D365) Finance & Supply Chain comes in. It’s a powerful tool that helps companies track, manage and understand all these hidden costs.

What Exactly is Landed Cost? It’s More Than Just the Purchase Price!

Landed cost isn’t just about what you pay the supplier for a product. It includes every single cost involved in getting that product from where it’s made all the way to your business doorstep, ready to be sold or used. Understanding this full picture helps you know the actual value of your inventory.

Here’s a breakdown of what usually goes into landed cost:

- Purchase Price: The basic cost of the item itself. This is the starting point, but not the whole story!

- Shipping & Freight: This covers all the ways your product travels, including:

- Inbound Freight: Costs for moving goods by ocean, air, truck or train from the supplier to you.

- Fuel Surcharges: Extra fees from carriers if fuel prices go up.

- Port Charges: Fees at the docks where ships load and unload.

- Duties & Taxes: Fees governments charge, especially for imported goods.

- Import Duties: Taxes on goods coming into a country.

- Customs Fees: Costs for getting your goods cleared through customs.

- Other Taxes: Like special taxes or sales tax (VAT/GST).

- Insurance: Money paid to protect your products in case they get lost or damaged during their journey.

- Handling Fees: Costs for all the “hands-on” work:

- Loading & Unloading: Fees for putting goods on and taking them off trucks, ships, etc.

- Warehousing & Storage: Fees for temporary storage.

- Inspection Fees: Costs for quality checks or regulatory inspections.

- Documentation Fees: Charges for all the necessary shipping paperwork.

How D365 Makes Landed Cost Easy

The Landed Cost module in D365 Finance & Supply Chain Management is an essential tool for businesses handling international trade or complex deliveries. It simplifies the management of shipping-related costs and improves cost accuracy.

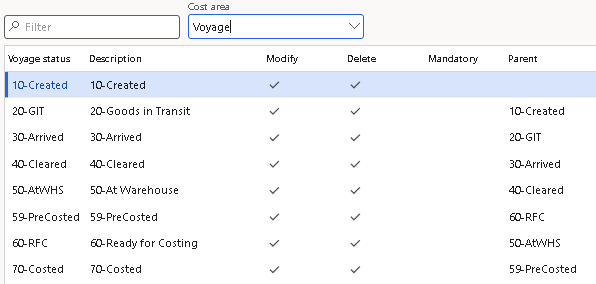

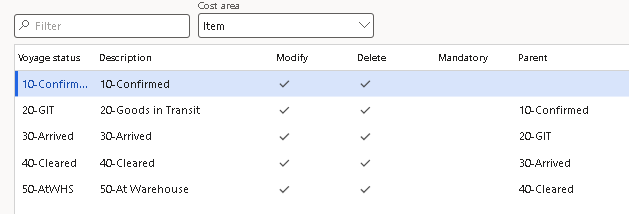

- Tracking Shipments (Voyages): The module lets you create voyage records that group all items, containers, and costs tied to a single shipment. It’s like a detailed logbook for your inbound goods, providing full visibility of what’s in transit and the associated charges.

- Comparing Estimates to Actual Costs: You can enter estimated landed costs when placing orders. As actual invoices are received, D365 allows you to update those estimates with real costs, helping you track variances and refine future planning.

- Flexible Cost Allocation: D365 provides configurable methods to distribute landed costs fairly across items in a shipment. You can allocate costs based on:

- Weight – for heavier goods

- Volume – for bulky items

- Value – for higher-cost products

- You can even set up your own rules! – using cost types you configure

These capabilities help ensure each product reflects its true landed cost, supporting more accurate valuation and better cost control.

Big Benefits of Getting Landed Cost Right

- Clearer Picture of Costs: No more guessing games! You’ll see exactly where every dollar is going, which helps you spot hidden fees and be more transparent about your spending.

- Accurate Inventory Value: By adding landed costs, D365 ensures your inventory’s value on paper is accurate, which is good for your financial reports.

- Better Profit Decisions: When you know the true cost of each product, you can set smarter selling prices. This means you’ll understand which products are truly making you money and focus on those.

- Easier Rule Following: Importing goods involves a lot of rules and regulations. D365 helps you track all the duties and taxes, making it easier to follow the law and avoid fines.

- Smarter Buying Choices: When you know the full cost from different suppliers and shipping routes, you can choose the best options, negotiate better deals and find ways to save money before the products even arrive.

The D365 Difference: A Complete Solution

Microsoft D365 Finance & Supply Chain offers a truly connected way to handle landed costs:

- Automated Cost Allocation: Once actual costs are entered, D365 automatically spreads them across your products based on your rules, saving you time and preventing mistakes.

- Import & Duty Calculations: The module helps you calculate and track import charges, duties, and taxes, simplifying international trade.

- Spotting Cost Differences: D365 provides tools to compare your estimated costs with the actual ones. This helps you quickly see where you might be spending more than planned and find ways to fix it.

- Works Seamlessly with Other Parts of D365:

- Procurement: Integrate landed cost estimates into purchase orders from the start.

- Inventory: Update item cost prices and inventory valuation in real-time.

- Finance: All the landed cost expenses flow directly into your financial records, simplifying bookkeeping.

Tips for Making Landed Cost Work for You

To get the most out of the Landed Cost module in D365, consider these best practices:

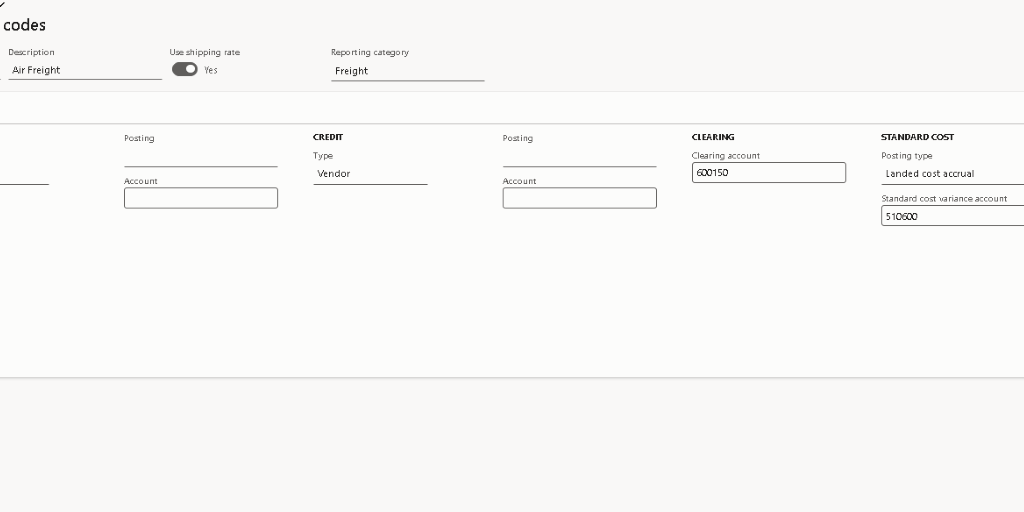

- Organize Your Costs: Configure cost types and cost groups logically; for example, by cost category (freight, duties, insurance) or by shipping method. This supports clearer tracking and easier allocation.

- Compare Estimates to Actuals: Use D365’s ability to record estimated costs at voyage creation and actual costs upon invoicing to monitor variances. This helps refine future cost planning and supplier negotiations.

- Break Down Costs: Set up detailed cost types (such as freight, customs duties, brokerage, handling). The more granular your cost setup, the better your reporting and analysis will be.

- Leverage Landed Cost Reports: Build reporting that highlights the impact of landed costs on product profitability and cost-to-serve. D365 provides data structures that integrate landed cost data into your BI tools, but you design this through SSRS, Power BI, or custom inquiries.

- Train Your Team: Ensure all stakeholders, from procurement to finance and warehouse teams understand how to manage voyages, costs, and receipt processes in the Landed Cost module to prevent errors and delays.

Stay tuned for Part 2, where we’ll explore how to measure success, answer common questions and unlock the full potential of the Landed Cost module in D365.