Volume 4, Issue 3

Summer is in full swing and here is the latest Tom’s Take on issues related to 2023 to 2024 U.S. Business Logistics Cost (USBLC) and year-over-year trends.

2024 U.S. Business Logistics Costs

The 36th edition of the State of Logistics Report was released in early June by CSCMP and Kearney. There are three cost categories that are tracked for the report, which include:

- Transportation Costs

- Inventory Carrying Costs, and

- Other Costs, such as IT and Administrative

Key findings from this year’s version of the report are:

- USBLC increased year over year from 2023 to 2024 from about $2.45 trillion to nearly $2.59 trillion, an increase of approximately 6.0% year over year (YoY).

- A summarized breakdown of costs per the three categories is as follows:

- Transportation costs make up roughly 64% of the total USBLC coming in at nearly $1.64 trillion in 2024. The major cost drivers within transportation include:

- Motor Carrier costs nearly $995 trillion.

- This includes truckload (TL), less-than-truckload (LTL) and private or dedicated fleets.

- Motor Carrier costs nearly $995 trillion.

- Parcel shipping costs $230 trillion

- Rail costs $97 trillion

- Air costs $100 trillion

- Water costs $162 trillion

- Pipeline costs of $80 trillion

- Inventory carrying costs (ICC) at 28.5% of the total USBLC

- Other costs, such as IT and administration costs at 7.0% of total USBLC

- Transportation costs make up roughly 64% of the total USBLC coming in at nearly $1.64 trillion in 2024. The major cost drivers within transportation include:

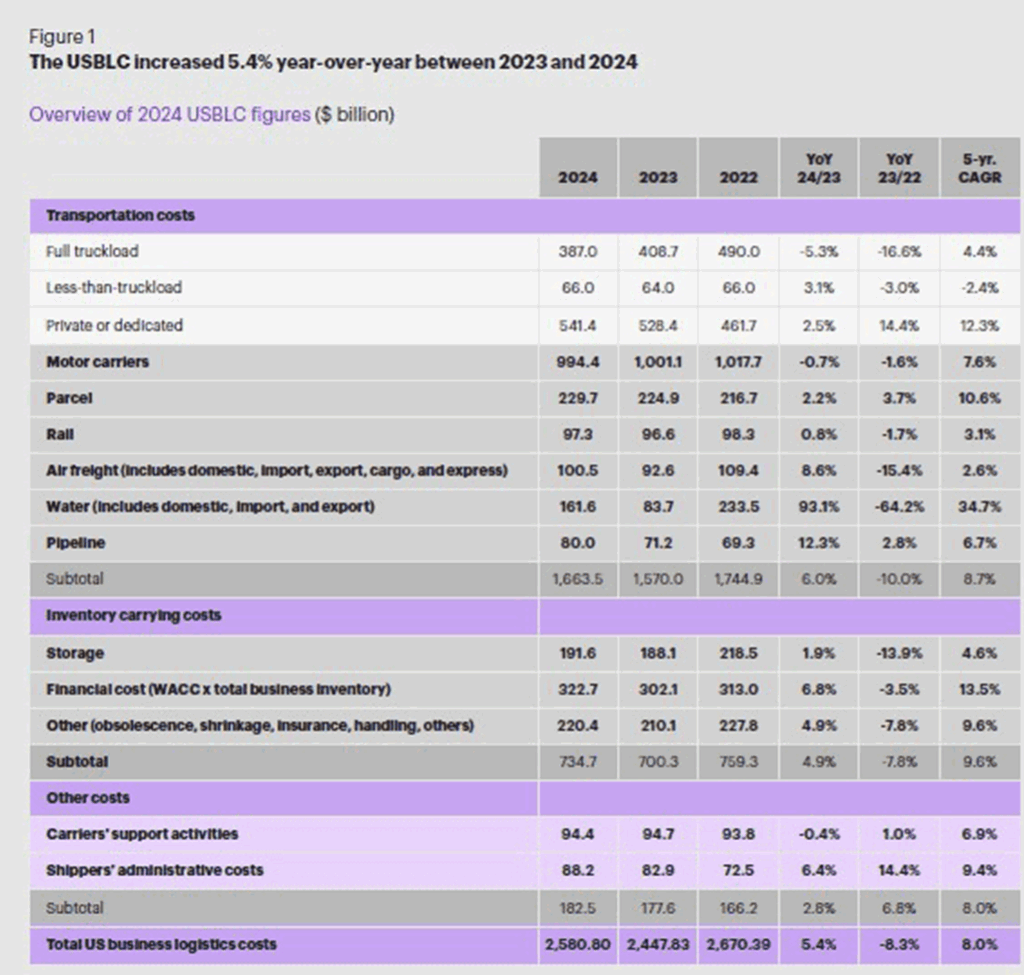

The table shown below outlines a detailed breakdown of the sub-costs within each of the three major categories and their year-over-year differences dating back to 2022 and their five-year compounded annual growth (CAGR) rates shown in the far-right column.

Tom’s Take – “USBLC has experienced an overall CAGR of 8.0% over the past five years. However, the increases have varied across the three categories within individual years, as shown above.

From 2022 to 2024, overall USBLC costs have decreased from $2.67 trillion to $2.59 trillion, a difference of 3%. This decrease can be attributed to lower transportation and inventory carrying costs, likely due to the U.S. and global economies stabilizing from the global pandemic. Specifically, large decreases in inventory storage, water and air transportation costs were the key contributors to the overall reduction.

Logistics professionals are encouraged to review their costs on an annual basis, benchmark against the overall costs and identify areas of opportunity for improvement, specifically related to transportation, warehouse and order management process assessments and software implementations.”

Learn how enVista can help address key supply chain challenges, such as labor, inventory and growth. Let’s have a conversation.®

Sources:

CSCMP’s Annual State of Logistics Report Executive Summary, Kearny

State of the Logistics Union 2025: First Thoughts, Dan Gilmore, Supply Chain Digest